Irs Tax Brackets 2025 Married Jointly. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket you’re in depends on your filing status:

Tax rate taxable income (single) taxable income (married filing jointly) 10%: The amt exemption is $85,700 for single filers, $133,300 for married filing jointly, $66,650 for married filing separately and $29,900 for estates and trusts. In 2025, the 28 percent amt rate applies to excess amti of $232,600 for all taxpayers ($116,300 for married couples filing separate returns).

They also both get an additional standard deduction amount of. Looking ahead to the tax year 2025, the tax brackets are anticipated to be adjusted further to account for inflation and.

Enter the amount figured in step 1, earlier, as the total taxable wages on line 1a of the withholding worksheet that you use to figure federal income tax withholding.

Irs Tax Brackets 2025 Married Jointly Latest News Update, For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $578,125 ($693,750 for married.

The 2025 Tax Brackets by Modern Husbands, For single taxpayers and married filing jointly, the amt rate is 26%, applying up to the first $232,600 of amt income for 2025, increasing to 28% for income above.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, In 2025, the 28 percent amt rate applies to excess amti of $232,600 for all taxpayers ($116,300 for married couples filing separate returns).

Tax Brackets Irs Married Filing Jointly Hot Sex Picture, They also both get an additional standard deduction amount of.

Oct 19 IRS Here are the new tax brackets for 2025, Tax rate single filers married filing jointly or qualifying surviving spouse married filing separately head of household;

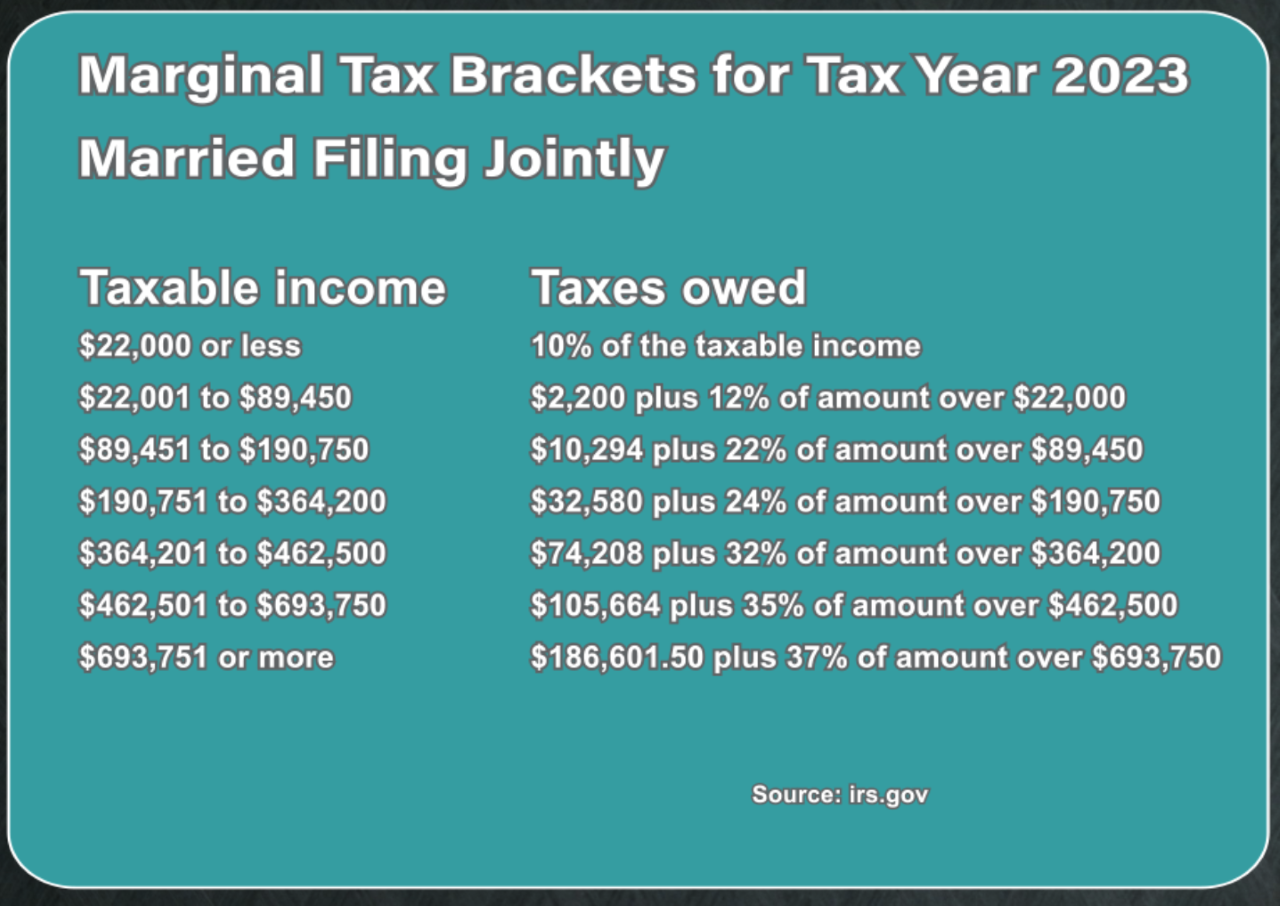

Tax Season Guide Married Filing Jointly vs. Separately Chime, Tax brackets for married filing jointly in 2025.

IRS Tax Brackets AND Standard Deductions Increased for 2025, The amt exemption is $85,700 for single filers, $133,300 for married filing jointly, $66,650 for married filing separately and $29,900 for estates and trusts.

The IRS Just Announced 2025 Tax Changes!, Tax rate taxable income (single) taxable income (married filing jointly) 10%:

What Are The Tax Brackets For 2025 Married Filing Jointly Printable, 10% for incomes between $0 and $11,000.

Moving into a higher tax. Tax rate taxable income (single) taxable income (married filing jointly) 10%: